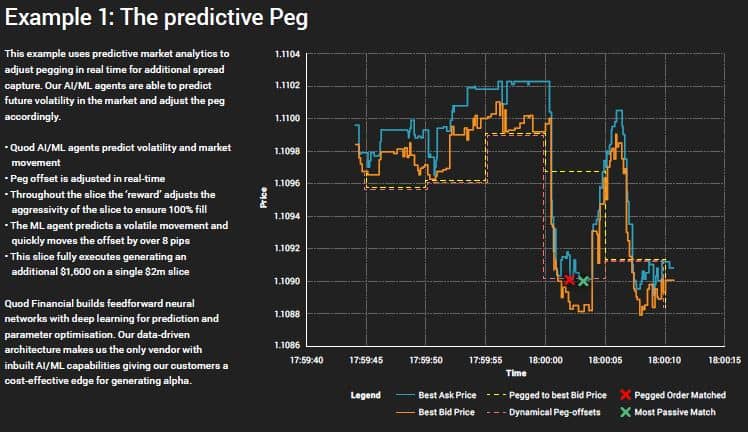

Quod’s NEW Predictive Peg Algorithm delivers Price Improvement over static Peg on 99.213% of Trades

The Predictive Peg algo is Quod’s latest development in their goal to deliver state-of-the-art trading capabilities to top tier institutions. It is yet another example of Quod’s commitment to innovation and further improving their data-driven approach to execution.

There is heavy investment in Machine Learning and AI in Quod’s Innovation Lab, with a desire to continue to improve Quod’s Execution Technology and pioneer the introduction of ML and AI in Trading; converting real-time market information into automated trading decisions.

What does it do?

The Predictive Peg is a dynamic Peg which uses a Reinforcement Learning System, this delivers Price Improvement over a static Peg on 99.213% of all Trades. It predicts the volatility of the market and adjust the Peg according to obtain the optimal execution price.

The Quod AI/ML ‘Quodrant’

The Quadrant is used by Quod in more than just Pegging algos, it has benefits from an execution perspective but also has operational improvements too. The 4 keys areas are:

Predictive Failure

This is an operational use to try and use our real-time system metrics to understand when something is going wrong.

Parameter Optimisation

Given an ‘intent’ from a trader such as low-market-impact, can we improve our parameter selection based on deep-learning.

Price Reversion

If we can predict market behaviour and volatility then passive strategies will be able to capture a better price.

Pre-Trade Strategy Selection

Using big data and analysis to predict which broker, route, algo or strategy will achieve the best outcome.

DOWNLOAD FULL PRODUCT BROCHURE HERE – THE PREDICTIVE PEG