The world of smart order routing (SOR) is undergoing a significant transformation. Advancements in technology, especially adaptive technologies and the integration of machine learning, are shaping the future of Intelligent Execution.

Adaptive Technologies: Regional Differences

In the United States, SOR implementations have traditionally relied on one round of liquidity scanning logic and rule-based posting. Large tier one brokers often have comprehensive connectivity to exchanges, ECNs, and ATS’, complemented by a SOR. The SOR in the US primarily operates on a sequence of actions, including initial decision-making based on a snapshot of the market and periodic decision-making at intervals.

In contrast, Europe has seen the need for more sophisticated SOR technology due to the complexity of its execution policies. The number of single exchanges and the high cost of non-display market data fees have influenced the approach. It’s worth noting that non-display fees are identical for all firms in Europe, regardless of trading or order size, which can be more favorable for large brokers and banks.

Machine Learning’s Role in SOR

Machine learning (ML) is a game-changer for SOR. It introduces implicit programming, enabling SOR systems to learn from historical data and make real-time decisions. In the context of SOR, ML can offer insights into probabilities of execution, calculate opportunity costs, and create predictive agents that enhance decision-making.

In both the US and Europe, ML is revolutionizing the way SOR operates. It brings data-driven insights into the decision-making process, allowing SOR systems to adapt to changing market conditions and optimize execution outcomes.

The New Trading Architecture: A Holistic Approach

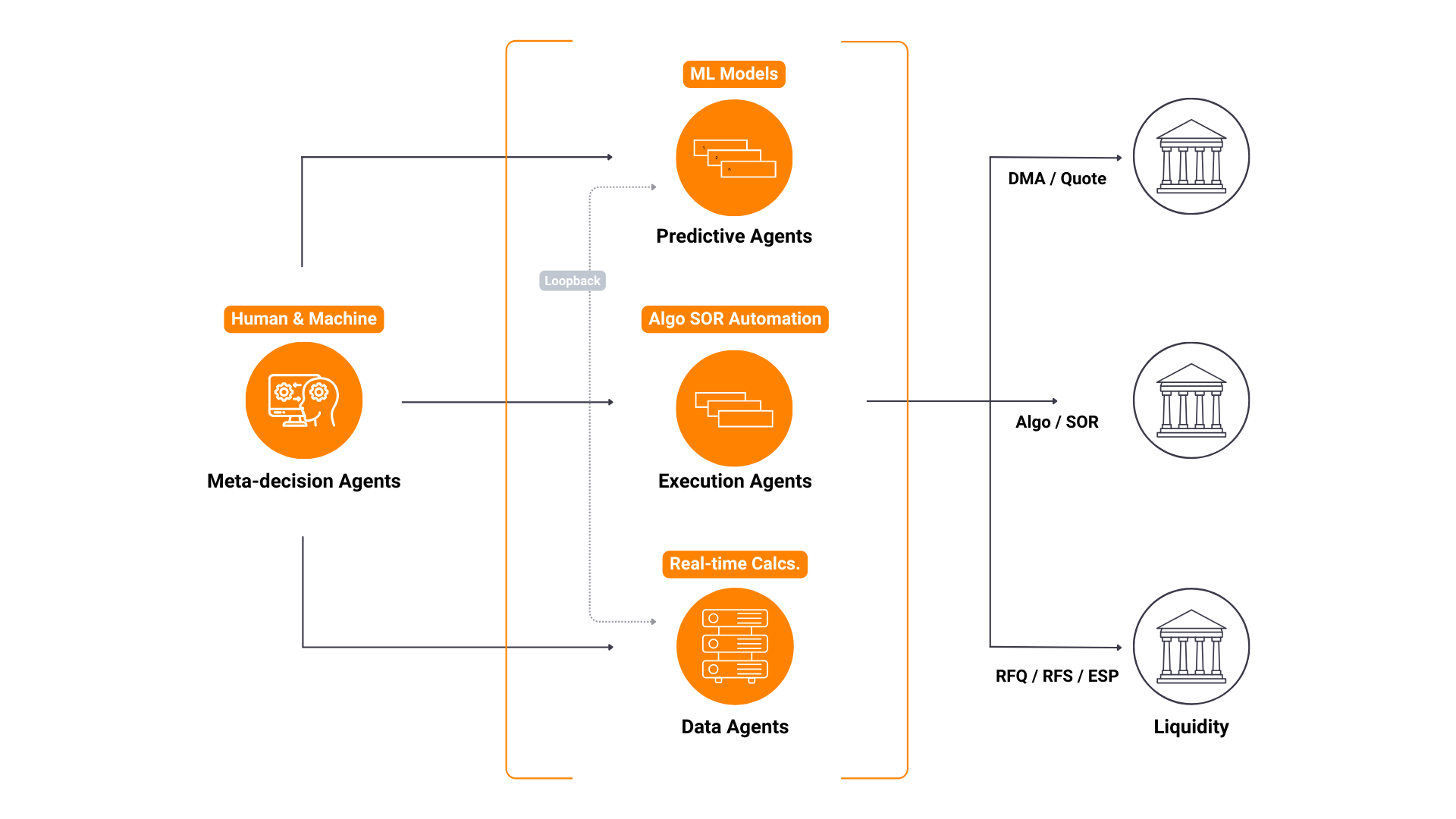

Looking ahead, a new trading architecture is emerging. This approach incorporates price and liquidity predictive agents, execution agents, and data agents. It integrates machine learning and adaptive technologies into a seamless, efficient system that benefits trading desks.

This holistic approach allows for more efficient and responsive SOR systems, enabling better decision-making and a deeper understanding of market conditions.

The integration of adaptive technologies and machine learning is reshaping the landscape of intelligent execution. Traders can leverage these innovations to optimize trading outcomes, reduce risks, and stay competitive in an ever-evolving market. By embracing these technologies, they position themselves for success in a data-driven trading world, ensuring they remain at the forefront of industry advancements.

—

About Quod Financial

Quod Financial is a multi-asset OMS/EMS trading technology provider focused on automation and innovation – specializing in software and services such as Algorithmic Trading, Smart Order Routing (SOR), and Internalization of Liquidity. Quod leverages the use of its data-driven architecture to support the demands of e-trading markets by combining AI/ML-enabled decision-making tools and dynamic market access with a non-disruptive approach to deployment. For more information visit: www.quodfinancial.com

Monika Kucharska

Quod Marketing

+44 20 7997 7020

marketing@quodfinancial.com