Unify Your Trading Stack — Your Apps. Your Choice.

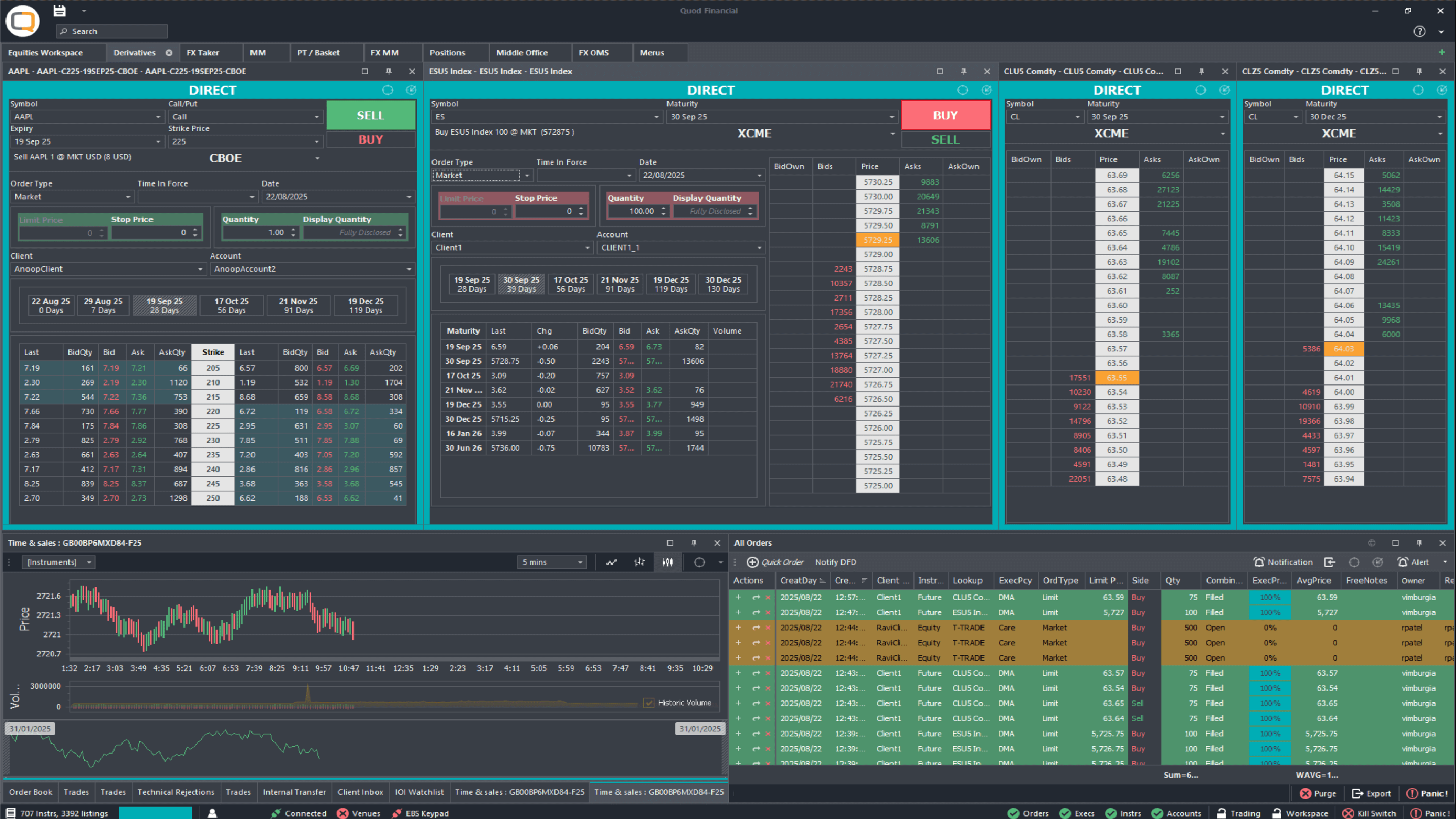

Quod Product Suite

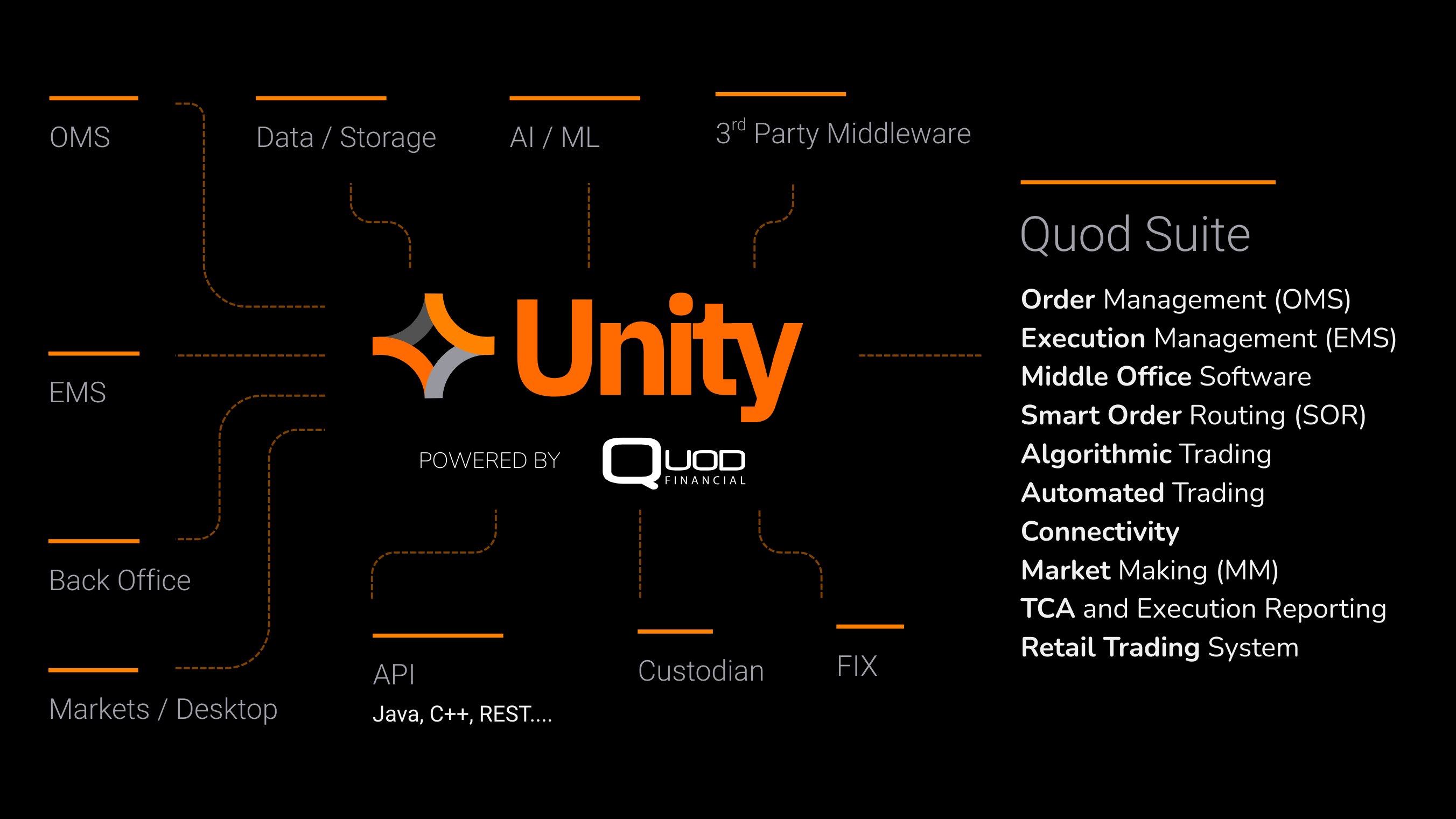

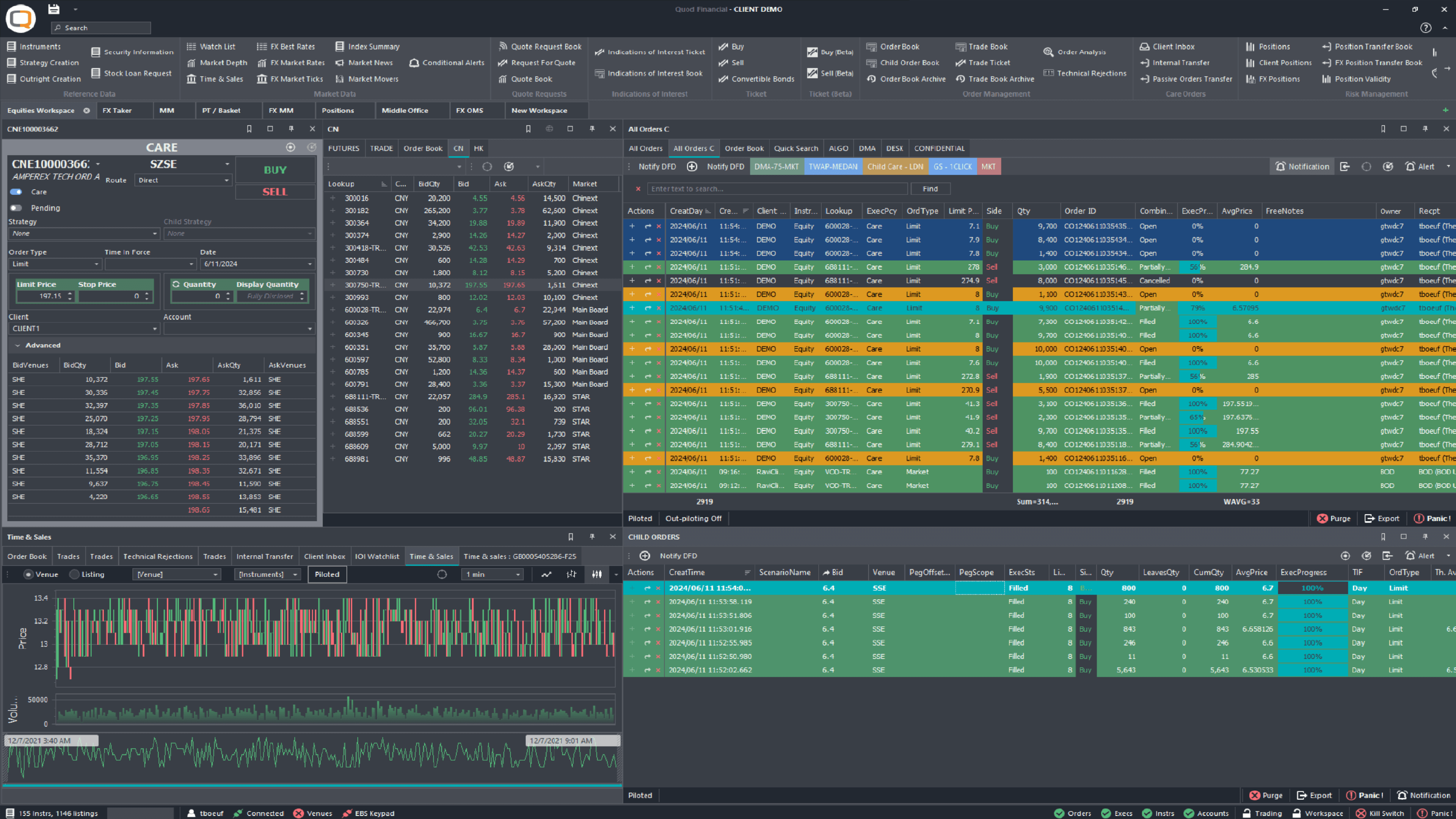

Access Quod’s microservice-based suite for execution, automation, and market access. Deploy only what you need — OMS, EMS, SOR, algo trading, connectivity, market making, retail platform, and more.

Unified Trading Architecture

Unity is the integration foundation connecting your OMS, EMS, AI/ML, market data, back-office, and post-trade systems, whether from Quod or any third party. Gain lifecycle-aware control, data normalization, and vendor flexibility across every asset class.

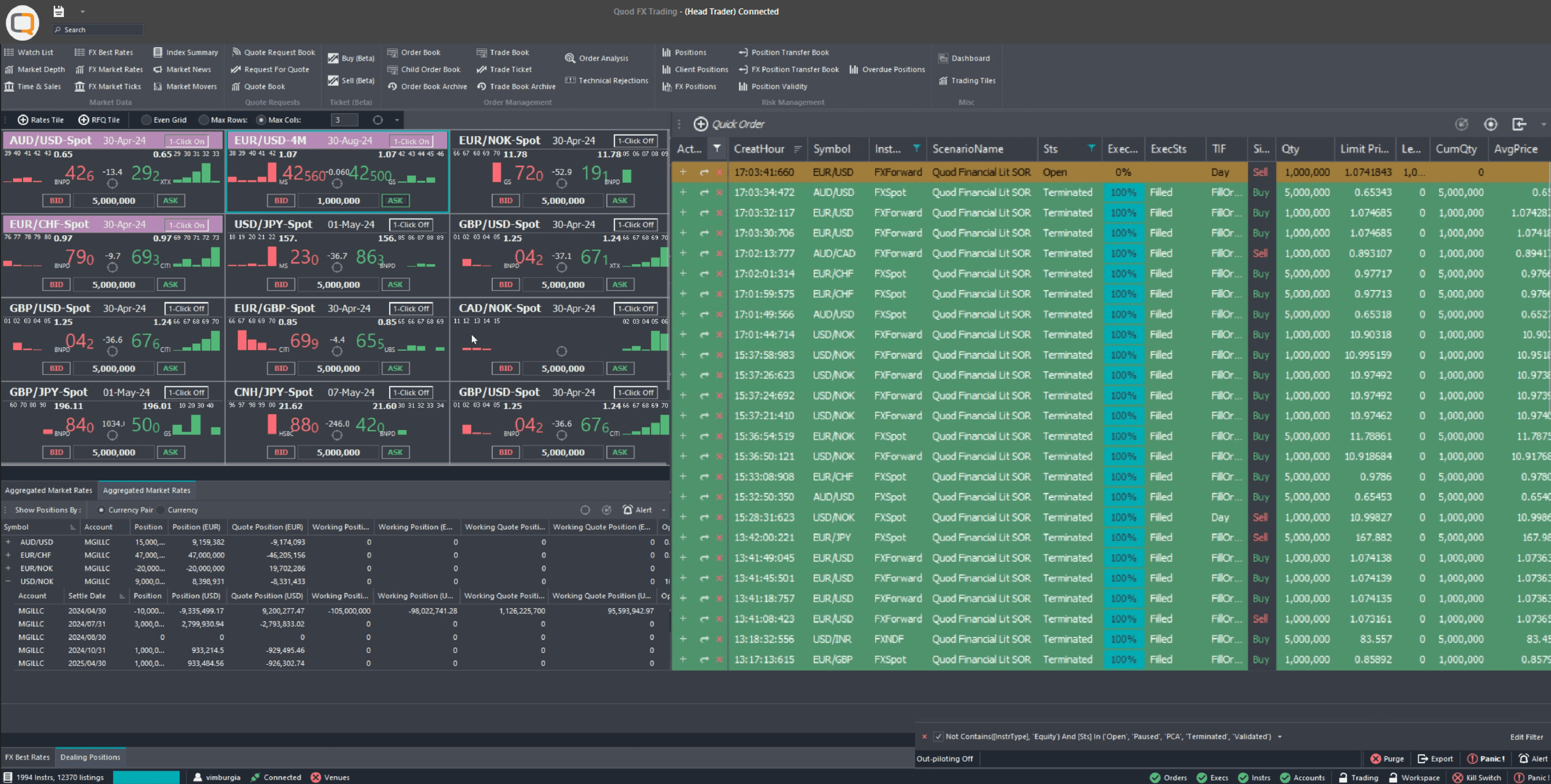

Best Trading Technology for FX

FX MARKETS E-FX AWARDS

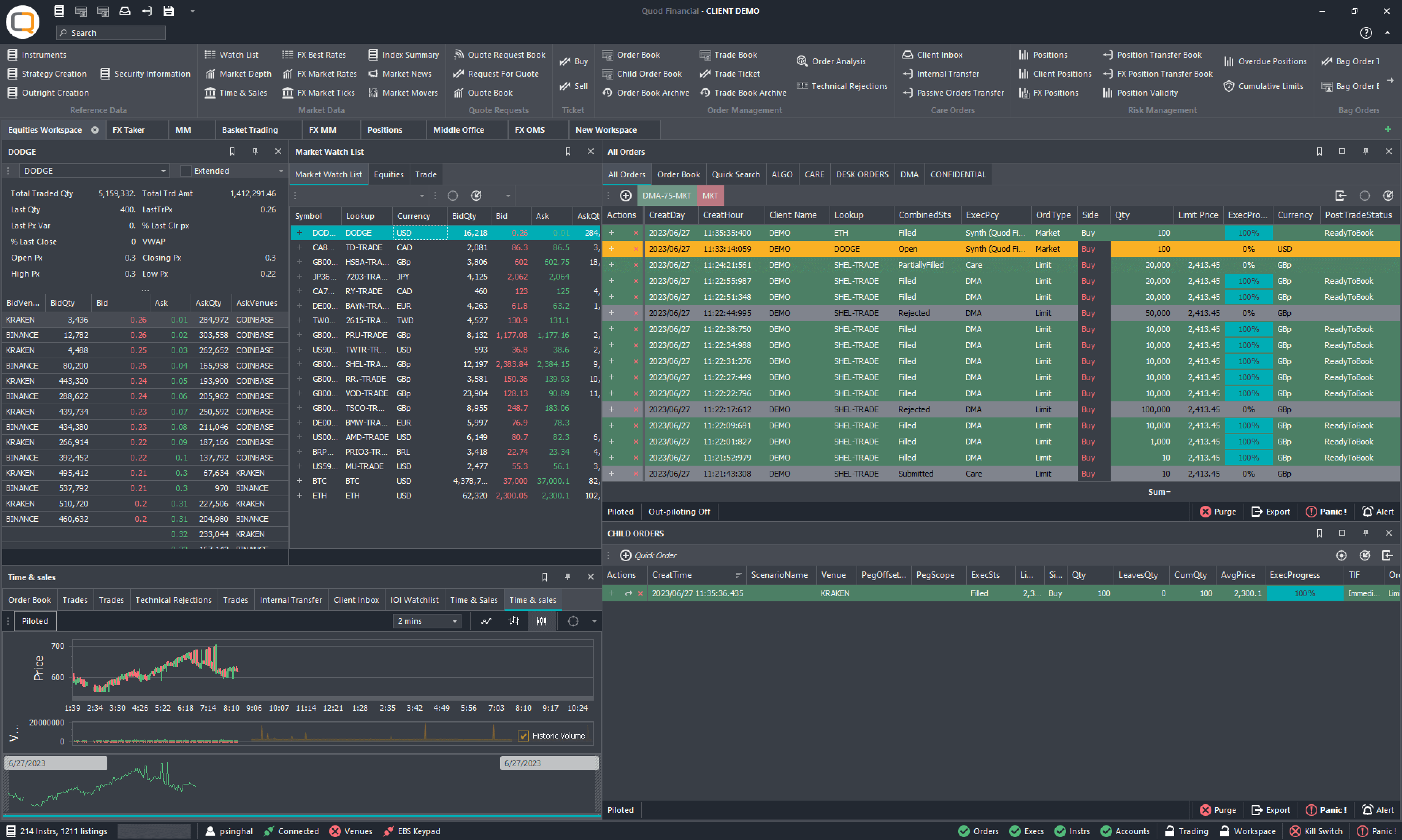

Best Equities Trading Solution

TRADINGTECH INSIGHT AWARDS USA

Best Smart Order Routing Application

TRADINGTECH INSIGHT AWARDS EUROPE

2024

Most Innovative AI in Trading Initiative

A-TEAM INNOVATION

2024

Best Sell-Side EMS

2023

Best Middle Office Platform

WATER TECHNOLOGY ASIA AWARDS

2023

Vendor Professional of the Year

WOMEN IN TECHNLOGY & DATA

2023

Best FX Trading Technology

FX MARKET E-FX AWARDS

2022

Best TCA Provider

FX MARKETS ASIA AWARDS

Earning global recognition.

for innovation and impact

Streamline Your Equities Trading with Comprehensive Order and Execution Management – Enhance Efficiency, Ensure Compliance, and Optimize Performance in Real-Time.

Who We Serve - Trading Technology

From Tier-1 brokers to digital-native execution providers, Quod Financial supports buy-side, sell-side, and fintech firms that require scalable execution, automation, and integration across fragmented markets.

Whether modernizing OMS/EMS workflows, scaling through APIs, or integrating AI-driven capabilities, Unity connects the entire trading stack.

We are impressed by Quod's passion and clear focus on bringing artificial intelligence (AI) and machine learning (ML) into their technology, as well as implementing steady improvements and innovative features to their multi-asset solution. This makes Quod's technology both future-proof and trend-setting in our industry.

Why Quod Financial - Product Capabilities

Real-time data intelligence

SOR & Algo trading platform

Pre-trade automation

Latest Insights and News - Thought Leadership

Medan Gabbay appointed

Co-CEO of Quod Financial

Quod Financial is pleased to announce the appointment of Medan Gabbay as Co-CEO, effective March 21st, 2025. Having previously served as Chief Revenue Officer (CRO), Medan will now lead the company alongside Ali Pichvali, continuing to drive the company’s growth and innovation in the trading technology space.

With a 20-year career spanning technology development and implementation across industries, Medan brings a unique blend of deep technical expertise and strategic business acumen.

Why Upstream Data Normalization Is Changing Trade Surveillance

FX Smart Order Router: The Route to Better Automation

Quod Financial Expands AI Ecosystem with Boltzbit Integration to Enhance Data Intelligence and Trading Performance

Frequently Asked Questions

Get to Know More About